Simon Lesser

July 12, 2013

Stepping off a plane from the UK and landing in Asia is a major culture shock. Everything about it is different. The heat, the food, the language and everything else you write home about. However, the SEO environment in Asia compared to the UK and the rest of the West may be the biggest shock to the system of them all.

So where to start? This topic is far too large to fit it all into one blog post, so this will mark the beginning a series of posts covering the differences between the SEO environment in Asia and the West.

Today we’ll begin by introducing the major search engines that make up the search environment in China. (We will not end here, I’m sure of it!)

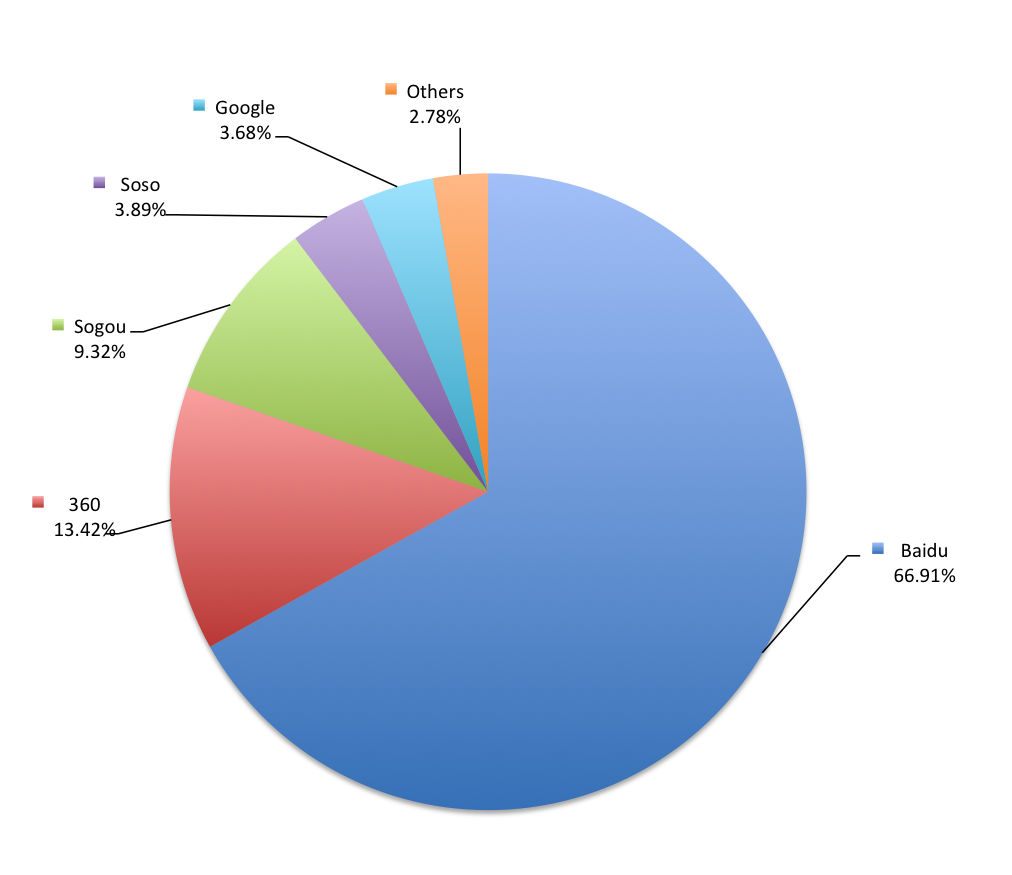

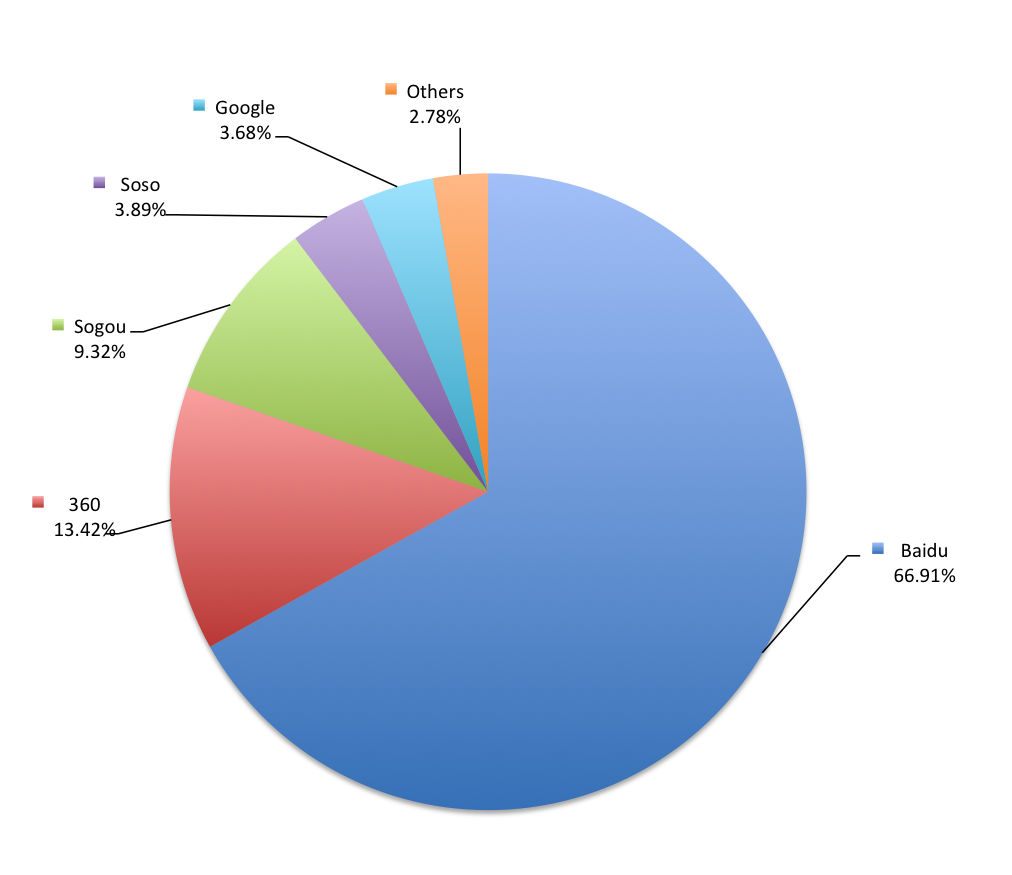

Coming from the UK, one only really needs to worry about Google, as it occupies a market share of approximately 86%. Google dominates the West. When it comes to China, however, there are a total of 5 major search engines – Baidu (66.91%), Qihoo 360 (13.42%), Sogou 9.32%), Soso (3.89%), and Google (3.68%).

UK Search Market Share, June 2013

China Search Market Share, March 2013

Sources: China Internet Watch

Stat Counter

If I had to monitor my client’s performance in 5 different search engines in the UK I’d have had a nervous breakdown. In China, however, it’s the norm. Given the massive number of internet users in China (expected to reach beyond 700 million in the next 2 years), even search engines with a smaller market share still have a large audience. In fact, Soso with a tiny market share of less than 4% still makes it the 56th most visited website in the world! In China, each search engine has a sizable audience worthy of a webmasters or marketing manager’s attention.

The Top 5 Chinese Search Engines:

Baidu: (66.91% market share)

- Baidu maintains by far the biggest share of the search engine market in China. It was the early mover and ‘took many cues’ (copied) from Google in its approach. You can even see this in the layout of the SERP’s. Although there are some differences with both the algorithm and results.

- Besides being an early mover, one of the main reasons for Baidu dominating the market is their ability to parse and interpret Chinese text more effectively than other search engines, leading to higher-quality results.

- The search engine gives much higher priority to Chinese language sites, and indexes far fewer non-Chinese language sites.

- Baidu, like Google does not restrict itself only to search, but offers a myriad of services such as maps, image and video search, news, a Wikipedia clone with over 5.3 million articles, and even a web browser.

- While Baidu has recently made significant steps forward in terms of transparency and effort to combat linkspam, many SEOs believe it’s far less sophisticated in detecting black hat techniques that Google.

Qihoo 360 (13.42% market share)

- The newest arrival to the scene, growing from 0% market share in July 2012 to Baidu’s closest competitor at 13.42% in under a year.

- The short version of their meteoric rise in Chinese search is that 360 primarily operated antivirus software before later creating a web browser, on which the default search engine was Google.cn. Later, they decided to displace the Google search function in their application and replace it with their own newly created search engine, taking advantage of a vast customer base.

- Qihoo 360 has caused quite a bit of commotion with their quick rise, upsetting nearly all of their competitors resulting in feuds and lawsuits.

Sogou: (9.32% market share)

- Known as a search engine, but is also strong in desktop applications such as Sogou Explorer (internet browser) and the very popular Sogou Chinese Input (Chinese language input method editor).

- Sogou’s algorithm attaches high value on site authority and original content, as determined by its own “SogouRank” index.

- Rumoured to be for sale, with Qihoo 360 touted as the most likely buyer in order to keep increasing their market share.

Google China: (3.89% market share)

Google China: (3.89% market share)

- A late start, disadvantage in parsing Chinese text, and a rough past with the Chinese government has kept Google from gaining hold in China.

- After a series of difficulties with Chinese authorities, Google relented to moving their searches from Mainland China to Hong Kong in order to bypass Chinese regulators and allow uncensored search.

- Currently, many Google services such as YouTube, Google+, and others remain blocked or throttled in China.

- These events have led to Google seeing their market share reduced dramatically in the past few years.

Soso: (3.68% market share)

- Owned by Tencent, whose other products include the popular instant messaging platforms, QQ and WeChat .

- Despite the low market share, as of October 2012 Soso had over 21 million site visits per day and was the 33rd most visited website in the world, (currently 56th). This speak volumes about the amount of internet traffic and users in China.

Each search engine has a different demographic and therefore has more importance for various businesses. Hardly a fully mature market, the competitive landscape here is still in flux, with some companies trying to get market share by buying out others or new product development.

Various online companies are now merging and trying to take market share off others and moving into new market spaces. Over the coming weeks I will profile each of these major search engines including criteria such as user demographics, SERP layout, and algorithms – all of which are important to understand when putting together your online marketing strategy.

When you consider each search engine has a large target audience, and a different target audience, SERP layout and algorithm, there’s a lot to cover in the coming weeks! Stay tuned.